Property tax estimator

218 E McCollum Avenue Bushnell Florida 33513. Taxpayer Rights Remedies.

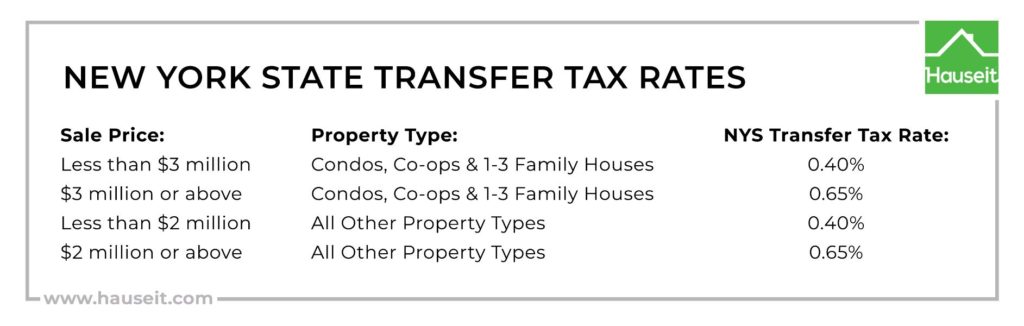

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

This Tax Estimator is a tool for prospective home buyers for estimating what the taxes will be on a particular piece of property.

. Hanahan City of Charleston Town of Jamestown Town of Bonneau Town of St Stephen Town of Moncks Corner City of Goose Creek North Charleston Goose Creek Parks and Playgrounds Sangaree Special District Town of Summerville. Internal Policy Directives are prepared to provide guidance to department staff to insure uniformity in tax administration. Excluding Los Angeles County holidays.

Those who may have just purchased a home or recently applied for homestead exemptions may find this tool especially useful. You will need your property tax folio number to apply. Property Tax Estimator Notice The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance.

Choose a city from the drop down box enter a propertyprice in the space provided then press the Calculate button. Estimated Property Tax. If you attempt to use the link below and are unsuccessful please try again at a later time.

To estimate your municipal taxes enter the property assessment values from your BC Assessment Notice in the boxes below. The Estimator Program also cannot. Type in your homes market value.

Residential Other Residential Non-Residential Farmland Multi-use Annexed The residential property assessment class includes single-family homes condominiums townhouses and other properties of three or fewer. Using the property tax estimator tool is easy as 1-2-3. In cases where the property owner pays their real estate taxes into an escrow account their mortgage company should request the tax bill.

Homestead Exemption and Portability. See the online functions available at the Property Appraisers Office. Your information will be updated regularly during.

This estimated calculation applies only to residential properties Class 01 for the tax year. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Duval County. The results displayed are the estimated yearly taxes for the property using the last.

We are accepting in-person online and mail-in property tax payments at this time. This property tax estimator can help you see how much a property of a certain value is required to pay in property taxes this year. Our property tax estimator is a great way to estimate your property taxes for the upcoming year.

Rates include special assessments levied on a millage basis and levied in all of a township city or village. Choose a tax districtcity from the drop down box enter a taxable value in the space provided then press the Estimate Taxes button. If you have questions about the.

Your county vehicle property tax due may be higher or lower depending on other. School District 41010 - Grand Rapids 41020 - Godwin 41050 - Caledonia 41110 - Forest Hills 41130 - Grandville 41145 - Kenowa Hills 41160 - Kentwood. All figurescalculations based on the 2021 tax year These are estimates ONLY - not exact amounts.

Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. Statutory exemptions including revitalization exemptions may affect the taxable values. The information presented on this site is collected organized and provided for the convenience of the user and is intended solely for informational purposes.

We can only provide estimates for the counties listed in the drop-down menu. Rates also include special assessments levied. Exemptions.

You can now access estimates on property taxes by local unit and school district using 2020 millage rates. The 2022 proposed budget includes a 69 increase in the property tax levy. Property Tax Estimator Property Tax Estimator.

The calculator should not be used to determine your actual tax bill. Changes in your propertys market value and changes in the Citys tax levy among other factors will impact what you pay in taxes next year. More Tax Roll Administration.

The tax roll is then certified by the Property Appraiser to the Tax Collector who in turn mails the tax noticereceipt to the owners last address of record as it appears on the tax roll. Property Tax General Information PDF Resources Forms. Use this estimator tool to determine your summer winter and yearly tax rates and amounts.

The actual tax amount for this property may be more or less depending on a variety of factors including changes to the millage tax rate and the inclusion of non-ad valorem assessments eg. The tax rates calculated using the Property Tax Estimator Program may change once taxing authorities budgets are certified in September. Rates include the 1 property tax administration fee.

Vehicle Property Tax Estimator Please enter the following information to view an estimated property tax. Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. This calculator is designed to estimate the county vehicle property tax for your vehicle.

830 AM - 500 PM Mon-Fri. Effective October 1 2021 we are resuming limited in-person services at the Kenneth Hahn Hall of Administration Monday through Friday between 800 am. Assessed values are subject to change by the assessor Board of Review or State Equalization process.

Legal The various Divisions of the Department of Treasury are guided by State statutes Administrative Rules Court cases Revenue Administrative Bureau Bulletins Property Tax Commission Bulletins and Letter Rulings. Census Bureau American Community Survey 2006-2010. Census Bureau American Community Survey 2006-2010.

The County is committed to the health and well-being of the public. The City of Saint Paul has created a property tax estimator to allow residents to understand estimated changes in their property taxes from year to year. Get an estimate of your property taxes using the calculator below.

Kansas Vehicle Property Tax Check - Estimates Only Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year Search By. The Fizber Property Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in any city nationwide. The Linn County Assessor may provide property information to the public as is without warranty of any kind expressed or implied.

Choose a search method VIN 10 character minimum Make-Model-Year RV Empty Weight And Year.

Secured Property Taxes Treasurer Tax Collector

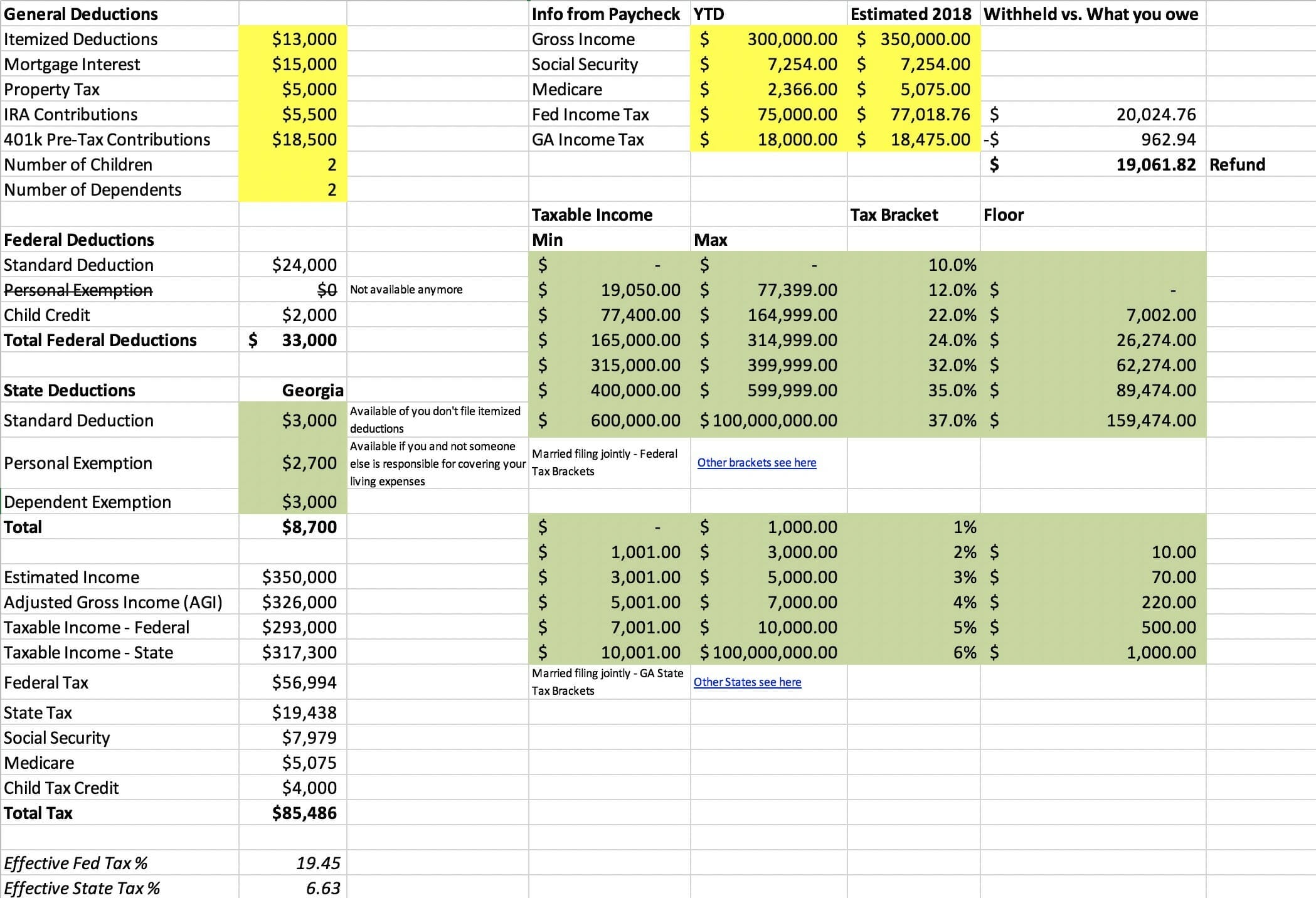

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

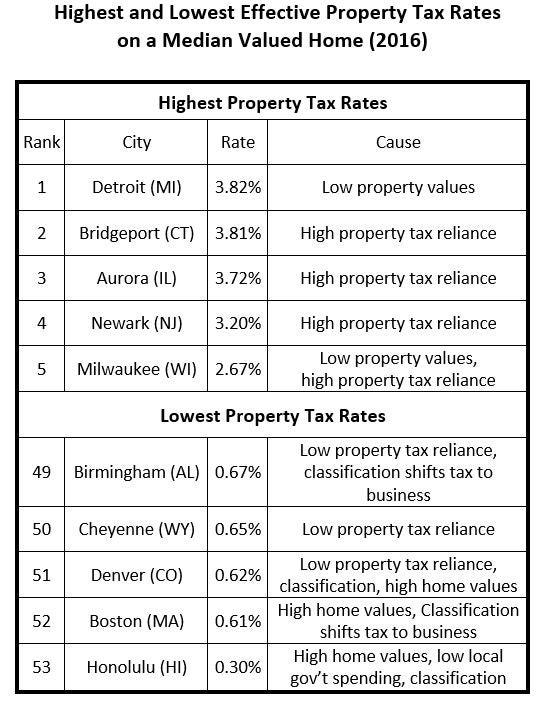

Property Taxes Property Tax Analysis Tax Foundation

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Property Taxes Property Tax Analysis Tax Foundation

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Real Estate Property Tax Constitutional Tax Collector

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Property Tax How To Calculate Local Considerations

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Property Taxes Property Tax Analysis Tax Foundation

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

2022 Property Taxes By State Report Propertyshark

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Harris County Tx Property Tax Calculator Smartasset

The Property Tax Equation

Kansas Property Tax Calculator Smartasset